What Is a Drug Formulary and Why It Matters for Seniors

A drug formulary is simply the list of medications your insurance plan covers. It’s not just a catalog-it’s a pricing system. Each drug on the list is placed into a tier, and that tier determines how much you pay out of pocket. For seniors on Medicare Part D or private insurance, this can mean the difference between paying $10 or $100 for the same pill.

Most plans use 3, 4, or 5 tiers. Tier 1 usually has the cheapest generics-think blood pressure or cholesterol meds. Tier 2 includes higher-cost generics and some brand-name drugs. Tier 3 is for expensive brand-name drugs with cheaper alternatives available. Tier 4 and 5? Those are for specialty drugs-like insulin pens, GLP-1 weight loss medications, or cancer treatments. These can cost hundreds per month.

The problem? Formularies change. Not every year. Sometimes every few months. A drug you’ve been taking for years might suddenly jump from Tier 1 to Tier 4. Your $15 copay becomes $75 overnight. And if you don’t check, you won’t know until you’re at the pharmacy counter.

How to Find Your Plan’s Formulary

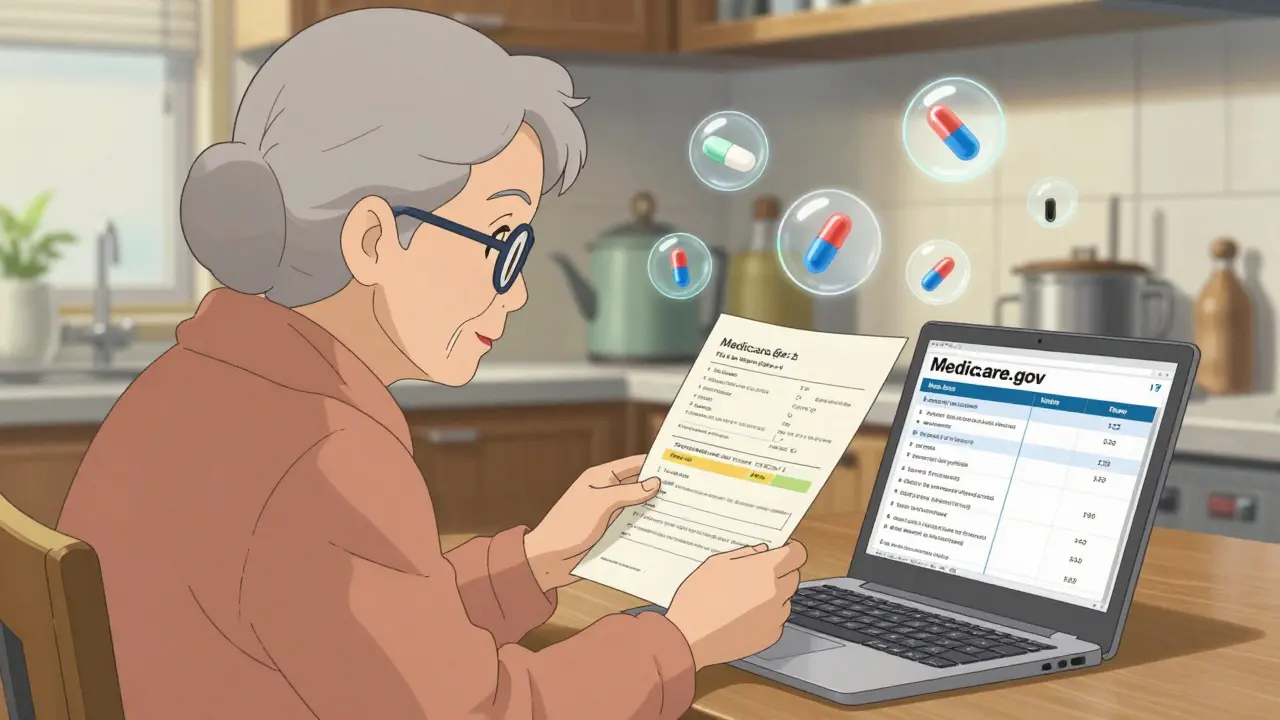

Start by logging into your insurance provider’s website. Most Medicare Part D plans-like Humana, Cigna, or Excellus BCBS-have a formulary search tool built right in. Look for tabs labeled "Drug List," "Formulary," or "Find a Drug."

Enter the exact name of your medication. Don’t use abbreviations. Type out "metformin ER 500 mg" instead of just "metformin." The system will show you:

- Which tier the drug is on

- Your copay or coinsurance amount

- Whether prior authorization or step therapy is required

If you’re on Medicare, go to Medicare.gov and use their Plan Finder tool. It compares formularies across all Part D plans in your area. You can even input multiple drugs to see which plan covers them all at the lowest cost.

Not sure where to look? Call your insurer. Customer service reps can email or mail you a full formulary list. Pharmacists can also look up your drug’s tier-just ask them to check your plan’s formulary before filling your prescription.

What to Look for When Formularies Change

Changes happen. CMS requires plans to notify you if a drug you’re taking is being moved to a higher tier, removed, or requires new restrictions. But here’s the catch: they only have to send you a notice if you’re currently using that drug. If you refill your prescription and suddenly pay more, you might have missed the letter.

Watch for these red flags:

- Your monthly cost increased without warning

- Your pharmacy says your drug now needs prior authorization

- You’re told your drug is no longer covered

Common changes in 2025 include GLP-1 drugs like Wegovy and Ozempic being moved into specialty tiers. In 2023, 17% of formulary updates involved raising the tier of a drug to increase patient cost-sharing-usually because a cheaper generic became available. But if your doctor says you need the brand-name version, you’re stuck paying more unless you file an exception.

How to Request a Formulary Exception

If your drug was moved to a higher tier or removed entirely, you can ask your plan to cover it anyway. This is called a formulary exception.

Here’s how to do it:

- Ask your doctor to write a letter explaining why you need this specific drug. For example: "Patient has tried two lower-tier alternatives and experienced severe side effects. This medication is medically necessary for stable blood sugar control."

- Submit the request through your plan’s online portal or fax/mail the form.

- Wait 72 hours for a decision. If it’s denied, you can appeal.

Approval rates vary. Some plans approve 80% of exceptions with strong medical justification. Others only approve 55%. Keep a copy of every document. If you’re approved, the plan must cover the drug for at least the rest of the year-even if it gets moved again later.

Pro tip: Some seniors don’t know exceptions exist. One Reddit user shared that after paying $600 for a drug that was suddenly in Tier 5, they called their doctor, filed an exception, and got it covered at Tier 2 for $35. That’s $565 saved in one month.

Compare Plans Before You Enroll

Don’t just pick the plan with the lowest monthly premium. Look at the formulary. A $20/month plan that puts your heart medication in Tier 4 could cost you $1,200 a year in copays. A $50/month plan with that same drug in Tier 1 might cost you only $300.

Use Medicare.gov’s Plan Finder to compare up to three plans side by side. Add your exact medications, dosages, and pharmacy. The tool calculates your total annual cost-premiums + copays. You’ll see which plan actually saves you money.

Also check:

- Does your pharmacy participate in the plan’s network?

- Are there step therapy rules? (e.g., try a cheaper drug first)

- Is there a coverage gap (donut hole) and how does the plan handle it?

Plans with 4 or 5 stars in Medicare’s rating system usually have better formularies. They cover more drugs at lower tiers and have fewer restrictions.

When and How Often to Check

Check your formulary at least twice a year: once in October before Medicare Open Enrollment, and again in January when new plan year formularies take effect.

Also check after:

- Any change in your medications (new prescription, dose change)

- Receiving a letter from your insurer about "changes to your drug coverage"

- Switching pharmacies or moving to a new state

Set a calendar reminder. Most seniors don’t realize their drug costs can spike mid-year. In Q3 2023, 42% of calls to Simply Prescriptions were from people surprised by sudden tier changes.

What to Do If You Can’t Afford Your Medication

If your drug is in a high tier and you can’t pay, you’re not alone. About 68% of Medicare beneficiaries report confusion about formularies, and many skip doses because of cost.

Options:

- Ask your doctor for a therapeutic alternative-a similar drug in a lower tier.

- Use GoodRx or SingleCare coupons. Even if your insurance doesn’t cover it, you might pay less out of pocket with a coupon.

- Apply for Extra Help (Low-Income Subsidy) through Medicare. It can cut your drug costs by up to 75%.

- Contact your State Health Insurance Assistance Program (SHIP). They offer free, one-on-one counseling on formularies and cost-saving options. In 2022, SHIP helped over 1.7 million seniors.

Common Mistakes Seniors Make

Here are the top errors-and how to avoid them:

- Mistake: Assuming your plan’s formulary didn’t change because you didn’t get a letter. Solution: Always check online yourself. Letters can get lost.

- Mistake: Using the same pharmacy without checking if it’s in-network. Solution: Verify your pharmacy is preferred on your plan’s website.

- Mistake: Not telling your doctor about cost issues. Solution: Say, "This medication is too expensive. Are there alternatives?" Doctors can often switch you to a covered drug.

- Mistake: Waiting until the last minute to switch plans. Solution: Start comparing in October. You have until December 7 to change.

Final Tips to Stay in Control

Keep a printed copy of your current formulary. Highlight your medications. Update it every time you get a notice. Share it with a family member or caregiver.

Use your pharmacist. They see formulary changes every day. Ask them: "Is this drug still on my plan’s list? Is there a cheaper option?"

And never assume. A drug covered this year isn’t guaranteed next year. In 2023, over 1.2 million formulary exceptions were filed by Medicare beneficiaries. That’s 1.2 million people who caught the change before it cost them more.

What’s Coming in 2026

By 2026, CMS plans to simplify formularies into a standardized 4-tier model. That means fewer confusing categories across plans. But it also means more drugs may shift into specialty tiers as prices rise.

GLP-1 drugs, insulin, and new cancer treatments will continue to be moved into higher tiers. AI-powered tools are coming-insurers plan to use them to recommend lower-cost alternatives before you even fill a prescription.

For now, the best defense is awareness. Know your drugs. Know your tiers. Know your rights. And never stop checking.

8 Comments

Angel Tiestos lopez

15 January, 2026bro i just found out my insulin went from $15 to $89 overnight 😭 and i didn't even get a letter. i thought my plan was "good"... turns out it's just good at hiding the fine print. 🤦♂️ #seniorproblems

Alan Lin

16 January, 2026It is imperative that all Medicare beneficiaries undertake a rigorous, systematic review of their formulary documentation on a biannual basis. Failure to do so constitutes a gross negligence of fiduciary responsibility toward one's own health and financial stability. The consequences of inaction are not merely monetary-they are existential.

Pankaj Singh

17 January, 2026You people are ridiculous. Why are you still on brand-name drugs? Metformin works fine. If you can't afford it, you shouldn't be taking it. Stop whining and get a job that pays better. This isn't a charity program.

Robin Williams

18 January, 2026YOOOOO I JUST FILED AN EXCEPTION FOR MY GLP-1 AND GOT IT DOWN TO $35!! 🎉 I was about to quit cold turkey but my doc wrote a letter and BAM-saved $500+ this month. You guys NEED to know this exists. Don’t let the system steal your health. Fight back. You got this. 💪🔥

Kimberly Mitchell

19 January, 2026The systemic failure of pharmaceutical cost transparency is not merely a regulatory gap-it is a moral abdication. The reliance on third-party coupon platforms like GoodRx reveals a profound institutional collapse. Patients are being forced to become amateur pharmacoeconomists. This is not healthcare. It is a market-driven survival game.

Angel Molano

20 January, 2026If you didn’t check your formulary, you deserve to pay more. It’s not complicated. Stop blaming the system.

Vinaypriy Wane

21 January, 2026I just called my SHIP counselor... and she helped me switch plans. I had no idea I could do this mid-year if I had a qualifying life event. I’m so grateful. Thank you, SHIP. 🙏 You’re the real MVPs. I wish more people knew this existed.

Randall Little

22 January, 2026So let me get this straight... you’re telling me that in 2025, in the wealthiest country on Earth, an elderly person has to play a game of bureaucratic whack-a-mole just to afford their heart medication? And the solution is... to check a website twice a year? Brilliant. Just brilliant. I’m sure the CEOs are sleeping soundly tonight.