Generic drugs used to be simple. You wait for a brand-name drug’s patent to expire, copy the active ingredient, sell it for pennies, and make money on volume. But that era is over. Today, the real action in generics isn’t in pills that look like the original-it’s in generic combinations. These aren’t just copies. They’re smarter, more complex, and designed to do better than the original drug-without the brand-name price tag.

What Exactly Are Generic Combinations?

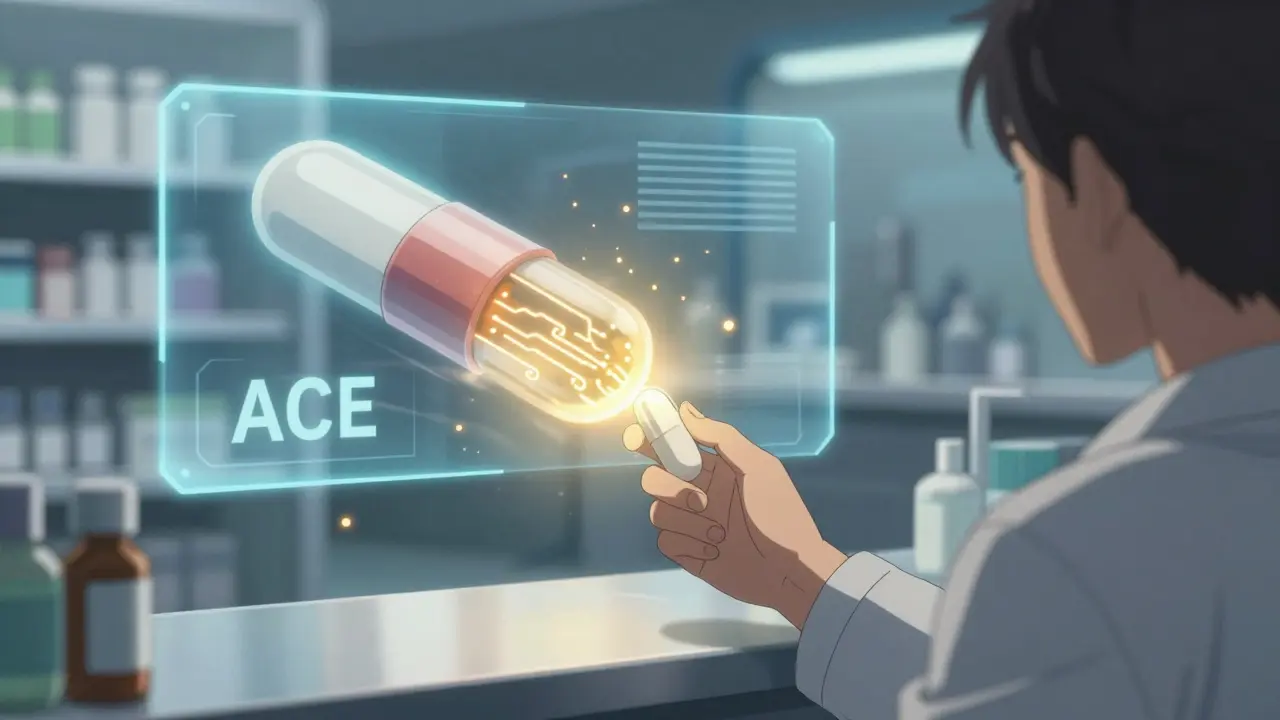

Generic combinations are medicines that combine two or more active ingredients into a single product, often with improved delivery systems. Think of them as upgraded generics. They include:- Fixed-dose combinations (FDCs): Two or more drugs in one pill, like a blood pressure pill that combines an ACE inhibitor and a diuretic.

- Drug-device combinations: Inhalers, auto-injectors, or patches that deliver drugs more reliably-like an EpiPen alternative with a better needle mechanism.

- Modified-release formulations: Pills that release medicine slowly over time, reducing how often you need to take it.

- Super-complex combinations: Nanoparticle systems or multi-component delivery platforms that target specific tissues or reduce side effects.

These aren’t just minor tweaks. They’re engineered to solve real problems: poor patient adherence, inconsistent absorption, or side effects from taking multiple pills. And they’re growing fast. The global market for these advanced generics-called super generics-is expected to hit $474.6 billion by 2035, up from $235.6 billion in 2025. That’s a 7.2% annual growth rate.

Why Are They So Much Harder to Make?

Making a standard generic is straightforward: match the active ingredient, prove it’s absorbed the same way, and you’re done. But with combinations, the rules change.For a fixed-dose combo, you don’t just prove bioequivalence-you have to show the combination works better than taking the drugs separately. That means extra clinical trials. For an inhaler or auto-injector, you’re not just a drug company anymore. You’re also a medical device maker. The FDA treats these as combination products, and they assign them to a specific review team under 21 CFR Part 4. This adds layers of complexity.

According to FDA data from 2024, approval times for complex combinations take 18 to 24 months longer than for simple generics. And the data needed? Up to 50% more. The biggest reason these applications fail? Not the active ingredient. It’s the delivery system. If the tablet doesn’t dissolve the same way, or the inhaler doesn’t deliver the right particle size, the FDA rejects it-even if the drug itself is identical.

Manufacturers need precision equipment. Tolerances for mixing ingredients must be within ±2%. Dissolution profiles must match the original product within a 10% f2 similarity factor. That’s not something a small generic shop with a few tablets presses can do. It requires investment in hot-melt extrusion, lipid-based delivery tech, and advanced analytical tools.

Why Companies Are Betting Big on Them

You might think: if it’s so hard and expensive, why bother? The answer is simple: margins.Traditional generics lose 80-90% of their price within two years of launch. A simple atorvastatin pill might sell for $0.05. But a complex combination-say, an extended-release version of bupropion for depression-can hold onto 40-60% of its original price for five years. Teva’s Budeprion XL brought in $187 million annually before generics hit. Meanwhile, standard bupropion generics together made only $42 million.

Why? Because these aren’t interchangeable. Doctors can’t just swap them out. Patients who need steady drug levels, fewer pills, or fewer side effects will stick with the better version. And insurers? They’re starting to prefer them too. Better adherence means fewer hospital visits. Lower risk of missed doses means fewer complications.

The market is responding. Complex combinations (drug-device, injectables) are growing at 9.8% CAGR-nearly double the rate of simple oral FDCs. Super-complex products like nanoparticle-based systems are growing at 12.7% CAGR. Oncology combinations, especially kinase inhibitors, are rising fastest at 11.3% annually. Respiratory combos like those for COPD and asthma are close behind.

Who’s Winning the Race?

The big players aren’t just surviving-they’re restructuring to dominate this space.- Viatris and Credence merged for $2.3 billion in early 2025 specifically to build scale in complex generics.

- Sandoz spun off from Novartis to become a pure-play generics company focused on high-value combinations.

- Aspen Pharmacare is developing generic versions of semaglutide combos-targeting the $100+ billion GLP-1 market.

- Catalent and Hikma are partnering to build auto-injectors for generic biologics.

These aren’t random moves. They’re strategic bets. The companies that can master formulation, regulatory pathways, and manufacturing precision are pulling away from the pack.

Meanwhile, manufacturing is shifting. India now produces 35% of the world’s complex generics. But the U.S. still leads in approvals-with 37 complex combinations cleared by the FDA through early 2025, compared to just 12 in the EU. Why? The EMA takes a stricter, more conservative view. That means companies have to tailor products for each region. A combo approved in the U.S. might need redesigning to meet European standards.

The Regulatory Wildcard

Regulation is the biggest variable in this game. The FDA is adapting. In October 2025, it launched a pilot program to fast-track reviews for generic combinations made entirely in the U.S. The goal? Cut approval time by 3-6 months. That’s a big deal for companies trying to beat competitors to market.But there’s a catch. Experts are warning that the definition of therapeutic equivalence for complex products is still fuzzy. Dr. Aaron Kesselheim from Harvard wrote in NEJM in 2025 that “the standards for what counts as a safe, effective generic combo are still evolving.” That creates risk. If a company claims a combo is better but the data isn’t rock-solid, it could lead to safety issues-or a costly FDA rejection down the line.

At the same time, global standards are getting tighter. The ICH Q14 guidelines, finalized in June 2025, now require consistent methods for testing complex formulations. That’s good for quality-but it raises the bar even higher for smaller manufacturers.

What’s Next? Three Trends to Watch

1. The Complexity Premium - Products with multiple innovations (e.g., extended-release + device + dual active ingredients) will command 2-3x the price of standard generics. This isn’t luxury-it’s necessity. Companies need to justify their $15-50 million development costs. 2. Regional Divergence - The U.S. will keep moving faster than Europe and other regions. Companies will need separate development paths for different markets. What works in the U.S. won’t always fly elsewhere. 3. Device-Pharma Partnerships - The future belongs to teams. Generic drugmakers are teaming up with medical device firms to build smarter delivery systems. This isn’t optional anymore. If you’re making an inhaler or injector, you need engineering expertise on your side.The Bottom Line

The future of generics isn’t about cheaper pills. It’s about better ones. The days of competing on price alone are gone. The winners will be the companies that can solve real patient problems-reducing pill burden, improving adherence, minimizing side effects-and do it at a price that pays for itself in healthcare savings.By 2030, super generics are expected to make up 35-40% of the total generics market value-even though they’re only a fraction of the volume. That’s because they’re the only way generic manufacturers can survive. With branded drug prices still sky-high and insurers demanding more value, the pressure is on. The old model is dead. The new one? It’s complex, expensive, and incredibly promising.

If you’re a patient, this means more effective treatments at lower cost. If you’re in the industry, it means a race to innovate-or get left behind.

What’s the difference between a regular generic and a generic combination?

A regular generic copies a single active ingredient from a brand-name drug and must prove it’s bioequivalent. A generic combination includes two or more drugs, often with a modified delivery system like extended-release or a device. It must prove not just equivalence, but therapeutic advantage-meaning it works better than taking the drugs separately.

Why are generic combinations more expensive to develop?

They require more complex formulation science, specialized manufacturing equipment, and additional clinical data to prove superiority. While a simple generic costs $1-5 million and takes 2-3 years, a complex combination can cost $15-50 million and take 4-7 years to develop.

Are generic combinations as safe as brand-name drugs?

Yes-if they’re approved. The FDA requires the same rigorous testing for safety and efficacy. The challenge is that complex delivery systems (like inhalers or injectors) are harder to test thoroughly, and standards for equivalence are still evolving. That’s why regulatory agencies are updating guidelines to close potential safety gaps.

Which therapeutic areas are seeing the most growth in generic combinations?

Oncology (11.3% CAGR), respiratory (9.89% CAGR), and central nervous system disorders (8.7% CAGR) are leading. These areas have high unmet needs, expensive branded drugs, and poor patient adherence-making them ideal for improved generic versions.

Why is the U.S. ahead of Europe in approving these products?

The FDA has adopted a more flexible, innovation-friendly approach to combination products, especially since 2020. The EMA remains more cautious, requiring stricter proof of equivalence and slower adoption of new testing methods. As a result, the U.S. has approved nearly three times as many complex generics as the EU through early 2025.

Can small generic manufacturers compete in this space?

It’s extremely difficult. The capital, expertise, and regulatory resources needed are beyond most small players. The market is consolidating, with larger companies acquiring niche developers or forming partnerships with device manufacturers. Small firms that survive are usually focused on one specific niche-like a single complex inhaler or a rare FDC.

12 Comments

Alex Curran

19 December, 2025Super generics are the future but the regulatory mess is insane

FDA and EMA are playing different games and manufacturers are stuck in the middle

One batch approved in the US needs a full reformulation for Europe

It’s not just about the drug anymore it’s about the device the dissolution profile the particle size

And don’t get me started on f2 similarity factors

Small shops can’t afford the HME machines or the analytical labs

This isn’t generics anymore it’s pharma engineering

And the margins? Still worth it if you can get through the approval gauntlet

Connie Zehner

20 December, 2025OMG I just had to switch to a combo inhaler last year and my asthma went from ‘daily rescue’ to ‘barely noticeable’

Also I’m obsessed with the new semaglutide combo patches they’re coming next year

Why can’t all meds be this smart??

Also I think we need a subreddit for combo drug nerds

😂

Alana Koerts

22 December, 2025Stop romanticizing super generics

They’re just brand-name drugs with a new label and a 500% markup

The FDA’s ‘therapeutic advantage’ standard is a joke

Most of these ‘improvements’ are statistically insignificant

Patients don’t care about f2 factors they care about cost

And now insurers are pushing these expensive combos because they’re ‘better’

That’s not innovation that’s profit engineering

Wake up

Emily P

23 December, 2025Can someone explain how the nanoparticle delivery systems actually work in practice?

I read the article but I’m not clear on whether the nanoparticles target tissue chemically or physically

And how do they avoid being cleared by the liver too fast?

Is there a surface coating involved?

Sorry if this is basic but I’m trying to understand the real science behind the hype

Dikshita Mehta

23 December, 2025India’s 35% share in complex generics is impressive but most of it is still oral FDCs

The real bottleneck is device-based combos - inhalers injectors patches

Those require sterile environments precision tooling and FDA-qualified process validation

Most Indian manufacturers lack the capital for that

They’re good at scale but not at complexity

China is catching up fast though - their new biologics facility in Shanghai is terrifyingly advanced

US and EU are going to lose ground unless they incentivize domestic production

Lynsey Tyson

25 December, 2025I work in pharmacy and I’ve seen patients switch from three pills a day to one combo pill

Adherence jumped from 42% to 89% in six months

That’s not just a win for the company

That’s a win for the patient’s health

Less hospitalizations less ER visits less stress

Yeah it’s expensive to make

But if it saves lives and reduces overall costs

Isn’t that the point?

Kelly Mulder

27 December, 2025Let’s be clear - the term ‘super generic’ is marketing nonsense

These are not generics

They are novel drug delivery systems with patent-protected components

Calling them generics is like calling a Tesla a ‘cheap Honda’

The FDA’s regulatory framework is outdated

They’re applying 1980s bioequivalence rules to 2025 nanotechnology

This isn’t innovation - it’s regulatory arbitrage

And the people who benefit? Not patients

It’s the Viatrises and Sandozes

with their $500 million R&D budgets

Vicki Belcher

27 December, 2025YESSSS this is the future 🥳

I’ve been on a combo pill for hypertension for 2 years

My BP is stable and I don’t have to juggle 5 different bottles

My grandma takes one pill a day now instead of seven

And she’s actually remembering to take it

That’s not magic - that’s science

And if it saves the healthcare system billions

Then I say bring on the nanoparticle magic 💫

Gloria Parraz

29 December, 2025The most dangerous thing about this shift isn’t the cost

It’s the illusion of choice

Doctors are being sold these combos as ‘superior’

But the data? Often funded by the manufacturer

And if you’re a small clinic without a clinical pharmacist

You don’t have the bandwidth to dig into the f2 curves or dissolution profiles

So you just prescribe what’s pushed

And patients end up on expensive combos that aren’t necessarily better

This is how healthcare becomes a sales funnel

benchidelle rivera

30 December, 2025Manufacturers are being forced to become engineers

And regulators are being forced to become scientists

But the system hasn’t caught up

The FDA’s pilot program is a start

But they need to create a new regulatory category

Not just ‘combination product’

But ‘complex therapeutic innovation’

With tiered approval pathways

Based on risk and clinical impact

Not just chemistry and device type

Otherwise we’re just slowing innovation to fit old rules

Nicole Rutherford

31 December, 2025Of course the U.S. leads - they approve anything with a pulse and a patent

Europe is right to be cautious

Remember the Vioxx disaster?

They’re not slow

They’re not stupid

They’re just not desperate to make shareholders happy

Meanwhile the FDA is handing out approvals like candy

And calling it progress

Wake up

anthony funes gomez

31 December, 2025The real question isn’t whether these combos work

It’s whether the system can sustain them

When innovation requires $50M and 7 years

And the return window is 5

And the regulatory landscape shifts every quarter

And the only players who can afford it are megacorps

Then what you’re not seeing

Is the death of diversity

Of small innovators

Of alternative delivery models

Of true competition

What you’re seeing

Is consolidation

And monopoly

Under the banner of ‘progress’